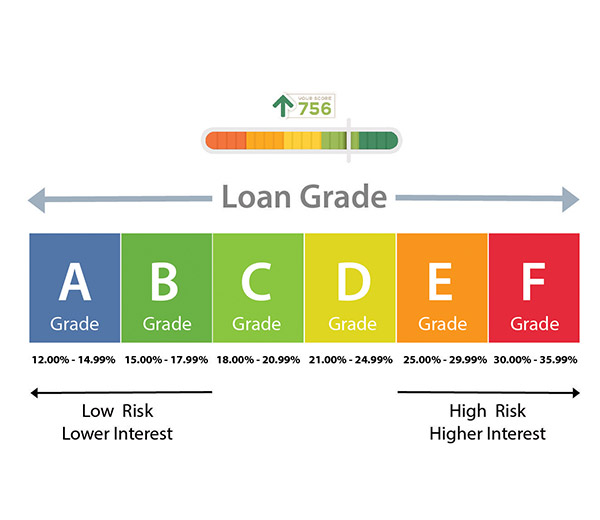

Up to 36% annual returns

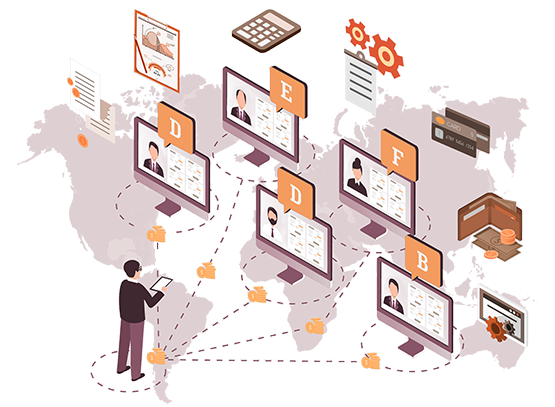

Digital investments from anywhere, at anytime

-

Generate an alternate source of monthly income

-

Get EMIs credited directly to your bank account

-

Start investing as low as Rs. 5,000

-

Machine Learning based credit underwriting

-

No stock market volatility